Investment Guide

Explore different investment options to help you build wealth and achieve your financial goals.

Index Fund Investing

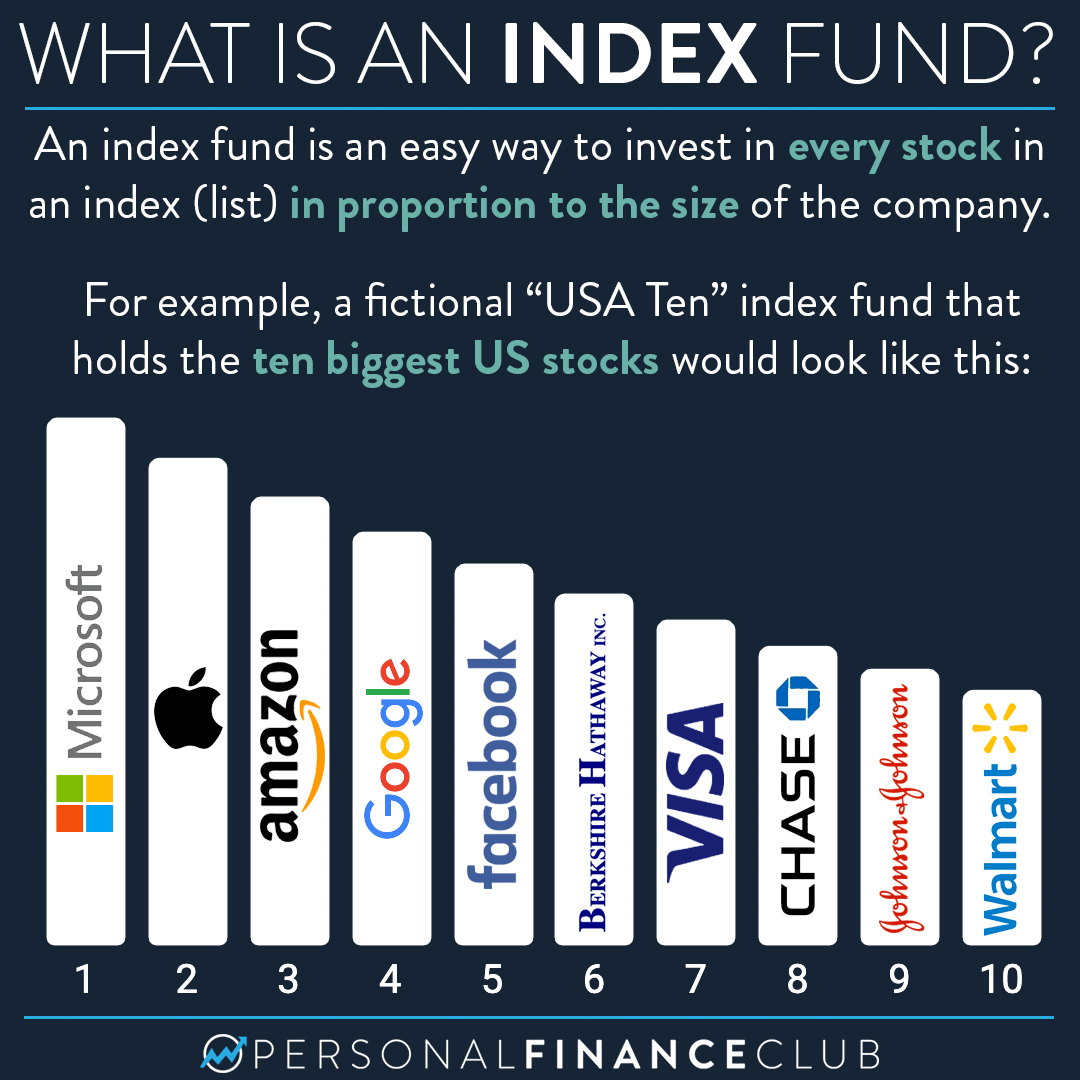

Index funds are investment funds that aim to replicate the performance of a specific market index, such as the S&P 500. They provide a simple way to diversify your investments across many companies with a single purchase.

These funds typically have lower fees than actively managed funds because they simply track an index rather than having managers actively pick stocks. This passive investing approach has historically provided better long-term results for most investors.

Types of Index Funds

Total Market Funds

Track the performance of the entire U.S. stock market, including small, mid, and large-cap companies.

Large-Cap Funds

Track indexes composed of large companies, such as the S&P 500.

International Funds

Track indexes of companies outside your home country.

Sector Funds

Track specific sectors of the economy, such as technology, healthcare, or energy.

Bond Index Funds

Track indexes of bonds rather than stocks.

Key Index Fund Concepts

- Expense RatioThe annual fee charged by the fund, expressed as a percentage of assets. Lower is better.

- Tracking ErrorThe difference between the index fund's returns and the actual index. Lower tracking error indicates the fund is closely following its index.

- ETFs vs. Mutual FundsIndex funds can be structured as ETFs (trade like stocks) or mutual funds (trade once daily).

- Tax EfficiencyIndex funds are typically more tax-efficient than actively managed funds because they buy and sell securities less frequently.

Popular Index Funds

Fund data is automatically updated hourly. Last updated: 8:00:15 AM

Why Consider Index Funds?

- •Low costs: Index funds typically have lower fees than actively managed funds.

- •Diversification: They provide instant diversification across many securities.

- •Simplicity: They're easy to understand and require less research.

- •Tax efficiency: They generally generate fewer taxable events.